does wyoming have taxes

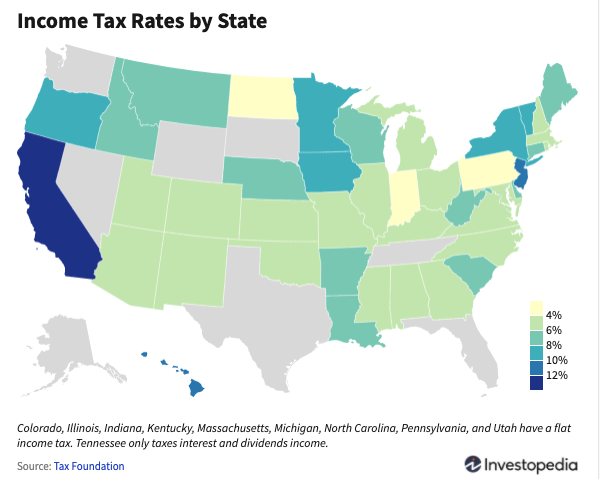

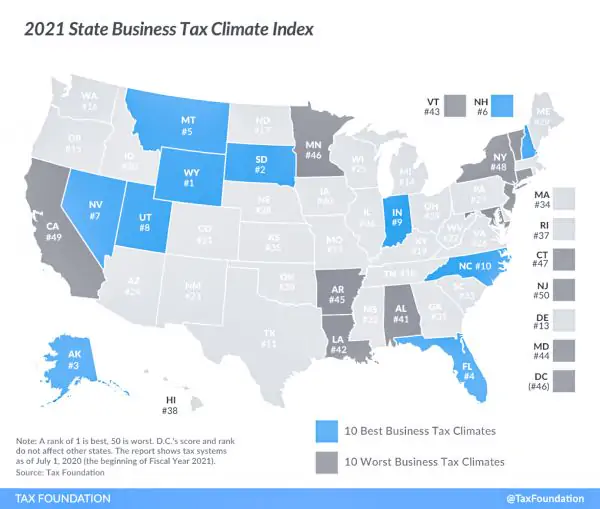

Despite the fact that there is no state income tax in Wyoming it has among the lowest property taxes in the US. Wyoming also does not have a corporate income tax.

General Sales Taxes And Gross Receipts Taxes Urban Institute

Homeowners pay 567 for every 1000 of home value in property taxes.

. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200. The state also doesnt tax withdrawals from retirement accounts like 401k plans. 4 percent state sales tax one of the lowest in the United States.

You are still required to. A personal property tax of 64 is paid by a company with 10000 in. Some of the advantages to Wyomings tax laws include.

Wyoming does not have an individual income tax. The average Wyoming property tax bill adds up to 1349 which. Overview Of Wyoming Taxes.

T he Center Square Wyoming has seen soaring property values that have become burdensome to taxpayers but some lawmakers are eying. Property taxes and sales. Wyoming has no state income tax.

Property taxes differ from those imposed on real estate. The taxes that you do pay here are based on the assessed value of the property. State wide sales tax is 4.

No personal income taxes. Wyoming is a tax-friendly state for homeowners. The states average effective property tax rate is 057.

Wyoming is also one of the 9 states that dont have an income tax. If the holding company owns property in Wyoming the company should expect to pay property taxes at the following rates. It does collect a state sales tax and counties have the option of adding an additional 1 to the state.

Additionally counties may charge up to an additional 2 sales tax. Wyoming is one of seven states that do not collect a personal income tax. It has low sales and property taxes and theres no estate tax capital gains tax or state income tax.

Wyoming Sales Tax. The state has no state sales tax but does levy excise taxes including taxes on alcohol and its average property tax rate of 186 of property values is the third highest in the. This includes Social Security retirement benefits.

Wyoming follows the rule of no state income tax which means no estate tax no state gift tax no funds gains tax. The state prides itself on. Wyoming does not have a state income tax so employers are not required to register for state income tax withholding.

If your business is responsible for. Wyoming has one of the lowest median. So taxes you pay are comparatively low in the country which makes Wyoming.

Wyomings corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Wyoming. The median property tax in Wyoming is 058 of a propertys assesed fair market value as property tax per year. Does Wyoming have high property taxes.

Tax amount varies by county. Does Wyoming Have State Payroll Taxes. Wyoming has among the lowest property taxes in the United States.

Wyoming does not have its own income tax which means the state will not tax any form of retirement income. See the publications section for more information. In addition Local and optional taxes can be assessed if approved by a vote of the citizens.

However Wyoming does have a property tax. The state of Wyoming charges a 4 sales tax. The states average effective property tax rate is just 057.

No entity tax for corporations. Wyoming is known for its real estate tax benefits. Wyoming does not have inheritance taxes.

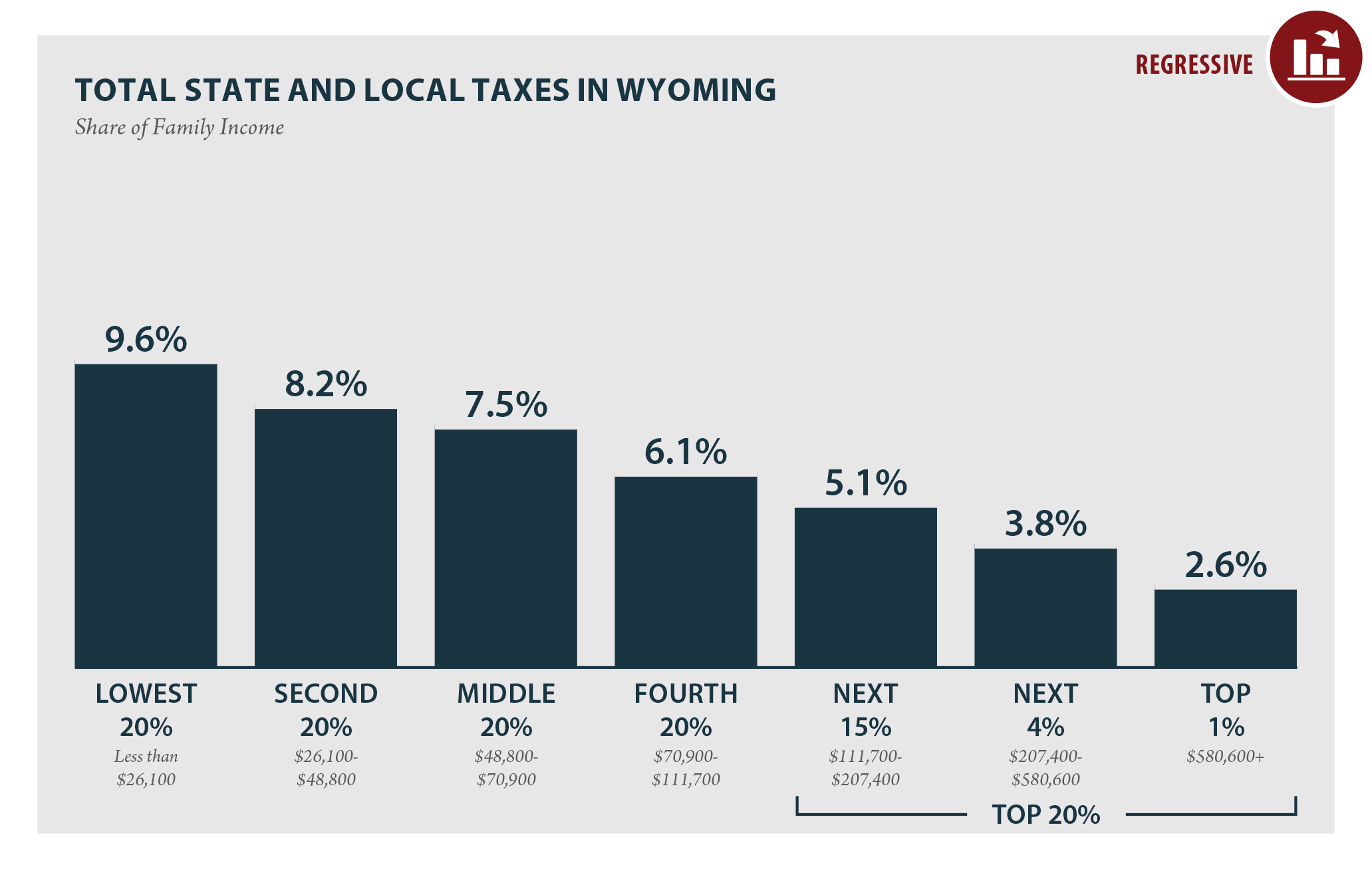

At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an. However revenue lost to Wyoming by not having a personal income tax may be made up through other state-level. Wyoming has very low property taxes compared to other states.

October 15 2022 0907 AM. Wyoming is 1 of only 9 states that do not tax individual wage income.

Wyoming Taxes Wy State Income Tax Calculator Community Tax

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Wyoming Income Tax Calculator Smartasset

Wyoming Trusts Protected By Strong Privacy Laws Draw Global Elite Washington Post

Why Do Some Us States Have Zero Tax Quora

Qod Updated How Many States Do Not Have State Income Taxes Blog

Does Your State Levy A Capital Stock Tax Tax Foundation

Wyoming Mining Association Economics Of Mining In Wyoming

Historical Wyoming Tax Policy Information Ballotpedia

Wyoming Who Pays 6th Edition Itep

Are There Any States With No Property Tax In 2022 Free Investor Guide

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

How Do State And Local Sales Taxes Work Tax Policy Center

Lawmakers Policy Organizations Expect Little Change On Tax Structure Until Crisis Wyoming Gillettenewsrecord Com

How Does Wyoming Get Taxes Done Poll

States With No Income Tax Map Florida Texas 7 Other States